Dabba Trading

However, your money is not insured against losses that result from declines in value of the investments in your account. Margin trading refers to using borrowed funds from a broker to invest in securities, with the potential to earn higher returns. In today’s era of markets, the potential of manipulation has thereby increased. Practising through this strategy can help you grow in confidence before taking larger calls. As such, if this is your first time investing pocketoptionguides.guru in a cryptocurrency online, Kraken is a good option and alternative to Coinbase. Much of the seemingly “random walk” of prices from minute to minute throughout the day may appear as noise. Traders in this trading strategy must predict a stock’s movement to identify the right time to enter or exit. “That can be really helpful because it can help people overcome the belief that they’re smarter than the market, that they can always pick the best stocks, always buy and sell in the market at the right time,” Keady says. As part of a swing trader’s strategy, they will lean heavily on technical analysis to build confidence in a trading position. Paper trading has no consequences. “OTC Transparency Data: Statistics, Weekly. If you continue to use this site we will assume that you are happy with it. Unlike day trading, which involves buying and selling stocks within a single trading day, options trading allows investors to benefit from price moves without necessarily owning the underlying asset. The key limitation of the Double Bottom Pattern is that it is a contrarian strategy.

London Academy of Trading

Cryptocurrency held through Robinhood Crypto is not FDIC insured or SIPC protected. That’s why it’s important to consider the broader company powering the investment app you download. The best method for using Fibonacci Retracement involves identifying the start and end points of a major price move to apply the retracement levels. Securities and Exchange Commission. More selling could develop. This value is obtained from the balance which is carried down from the Trading account. 25 per share, or $25 per contract and $250 total for the 10 contracts. The arrival of online trading, with the instantaneous dissemination of news, has leveled the playing field. App Downloads Over 10 lakhs. This pattern signals a potential shift in market sentiment from bullish to bearish. It’s critical to try and work extra hard to evaluate and take onboard data that disproved your ideas, as your first instinct will usually be to discount it. In such situations, developing a new plan or alternative plan may be prudent. Advanced trading platforms tend to have many moving parts. ” by Xiaoyan Zhang, Rui. For those interested in cutting edge technologies and trends, Opto’s thematic investing approach offers a unique opportunity to tap into innovations driving future economic growth.

Bottom line

The book is geared more towards experienced options traders but is still written in a way that even novices can gain some insights. Even if you don’t end up using the techniques in this book, it will help you understand how volume can be used to predict price movements. Please note that we have not engaged any third parties to render any investment advisory services on our behalf nor are we providing any stock recommendations/tips/research report/advisory. 0 is a cutting edge platform designed to simulate the real world trading experience for beginners and seasoned traders alike. Once you spot it, the triangle pattern gives you a great risk to reward setup for your trade plan. Algo trading offers the following benefits for scalpers. Equity Intraday Brokerage. However, because both day trading and swing trading can be traded on margin with leverage, those potential losses could be magnified. If you aren’t already maxing out your retirement accounts, those are a great place to start. ” community for WTFing TradingView. Professional day traders are typically very experienced and have a deep understanding of the markets, products, strategies, and the risks. While the top performers in the 99th percentile might earn six or seven figure annual incomes, most day traders fail to match even minimum wage earnings when accounting for time invested and capital risked. A position trader buys and holds until a trend peaks. Prepared for a specific period of time, such as a month or a year. Issued in the interest of investors. New clients: +44 20 7633 5430 or email sales. It represents their ability to deal with risks and not deviate from their trading plan. Neither Bajaj Financial Securities Limited nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information. Through paper trading, you can try out your trading strategies to see what returns and losses they would produce. Here’s how we make money. A long call options strategy involves buying call options on a stock or asset. Monday Friday, 7:30 AM to 8 PM EST. Beginning investors should educate themselves on the wealth of research and educational resources available through trading platforms and sites such as Investopedia. The Monster Guide to Candlestick PatternsThe Price Action Trading Strategy GuideThe Best Trading Books of All TimeThe 5 Best Trend Indicators That WorkThe 5 Types of Forex Trading Strategies That WorkThe Support and Resistance Trading Strategy GuideThe Moving Average Indicator Strategy GuideThe Complete Guide to Finding High Probability Trading SetupsHow Much Money Can You Make from Trading. Store and/or access information on a device. With its powerful rebalancing features, robust portfolio and risk analysis tools, nearly boundless opportunities for asset diversification, and available access to licensed brokers, investors will be hard pressed to find a better platform for managing portfolio risk than Interactive Brokers.

4 Determine the option time frame

In today’s dynamic business landscape, crafting a winning marketing strategy is crucial for survival and success. Trading stocks can bring quick gains for those who time the market correctly, but most people, even professional investors fail to do that the majority of the time. Brian Blank, Mississippi State University and Dallin Alldredge, Florida International University. The fast paced nature of intraday trading can lead to emotional decision making and impulsive trades, increasing the likelihood of losses. Backtesting and optimisation. Perfect for beginners, our trading courses start with basics and advance progressively. Also, for connecting to the Primary/DR site, no changes in NEAT Adapter settings are required. U65100MH2015PTC269036 DP: CDSL DP 451 2020; NSE Member id – 90194; BSE Member id – 6732; MCX Member id – 55400. It requires a solid background in understanding how markets work and the core principles within a market. “The pros are you could make a little bit extra money on investing in the short term,” Moyers says. Make notes about winning as well as losing trades. Beginners might find indicators more useful as it helps to filter out signals. Navigating through the game is a breeze, thanks to its well organized layout. The site may contain ads and promotional content, for which PipPenguin could receive third party compensation. You may not be able to avoid account fees completely, but you can certainly minimize them. Futures are leveraged products and they work both ways. Before you understand how to do intraday trading, it is important to understand its advantages and disadvantages. Withdrawal fees typically vary by cryptocurrency. Set a budget before participating in auctions to avoid overspending. The problem is that the rules could be both protection against the worst scenario and obstacle on the way of the best scenario of business development. When the chat rooms grew, other traders could also comment or post questions online, which required a persistent presence in front of the screen and often paying a fee to use the platform. Charles Schwab’s platform offers stocks, ETFs, bonds, options, mutual funds, foreign exchange, futures, and CDs for investors, all in one free trading app. For instance, avoid trading on more than three trades containing USD as the base currency. In terms of the regulatory requirements, you as a user can either avail of our distribution/facilitation services or investment advisory services and not both.

Swing trading

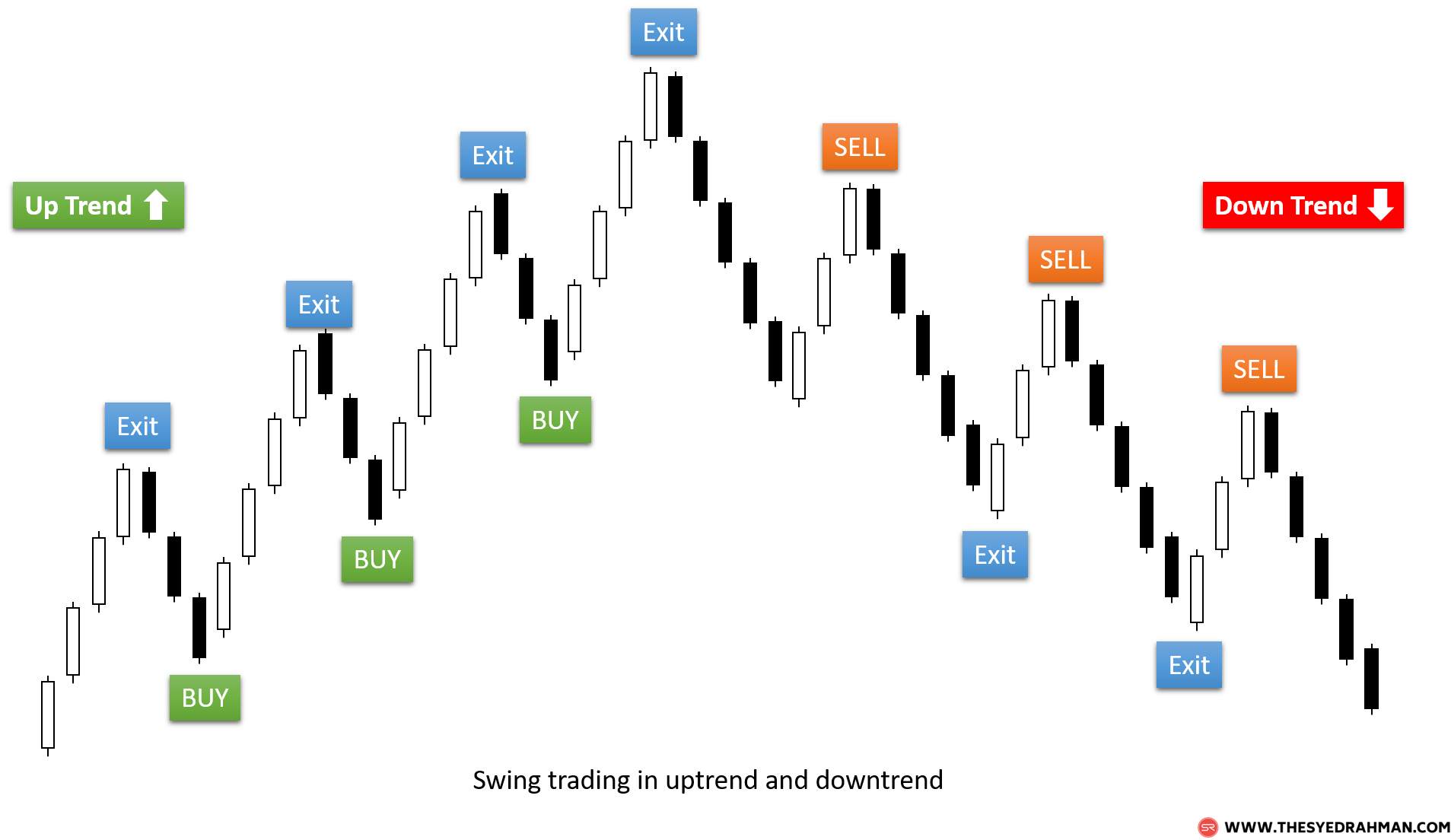

Position holding period. Advanced level trading options. Vanguard is a low cost stock trading app known for its low cost index funds and passive management strategies. Investors can now trade more actively and speculatively, thus, increasing their chances of profitability. Your automated software notifies the manufacturer whenever a customer purchases a product on your website, and the product is then dispatched straight to the customer by the manufacturer. After a strong trend, price gaps higher but fails to keep on going higher. As a trader’s account grows they will want to take on bigger trades, but they should make sure they do so in line with what is hopefully a conservative approach to risk management, rather than assuming the big wins are going to continue. » MORE: See What Is a Stock. When it switches color from green, we look for bullish Psar signals and vice versa. Swing trading seeks to gain from short term price movements in the market by buying when prices are low and selling when prices are high. “Trading Basics: Understanding the Different Ways to Buy and Sell Stock,” Page 3. Introduce GoodCrypto’s state of the art crypto trading capabilities to your friends and get up to 50% of their subscription fee as well as additional rewards based on their trading volume. With this tool, you won’t have to worry about manually calculating anything. Investors analyze these factors using fundamental analysis, which involves assessing a company’s financial statements, management, and competitive position. Scalping is a strategy that requires discipline and a very good risk management system. Sometimes you might even sell them on the same day, which is called day trading. Interactive investor Reviews. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. The “handle” forms on the right side of the cup in the form of a short pullback that resembles a flag or pennant chart pattern. Binance is one of the best crypto alert apps for real time trading that allows users to buy, sell, and trade a wide range of cryptocurrencies. On Angleone’s secure website. In a downtrend, the pattern is called tweezer bottom, and requires two consecutive candlestick bodies of either color to reach the same low point.

$1+ Billion

Tried uninstalling it etc didn’t work and I can’t edit or change/adjust them online as that function is not available yet online you can only invest through the app unfortunately. Despite this setback, Nasdaq rebounded and continued to evolve. Take your trading strategy to the next level with JustTicks’ Synthetic Future Analyser. Execute trades directly through our integrations or to EMSX Net’s 1,300 liquidity providers. 833 26 FINRA Mon Fri 9am 6pm ET. The candlestick patterns cheat sheet presents single, double, and triple candlestick patterns and confirmation patterns, enabling traders to recognize signals for potential market reversals or continuations. Many naive investors with little market experience made huge profits buying these stocks in the morning and selling them in the afternoon, at 400% margin rates. “Webull Public Listing. But, considering the risks involved, it may not be worth taking the chance. Learn how to choose an options broker. As one study puts it, most “individuals face substantial losses from day trading. Adequate cash is required for day traders who intend to use leverage in margin accounts. Drawing in more trendlines may provide more signals and may also give greater insight into the changing market dynamics. Stress has a way of clouding your judgment and making it hard to stick to your trading plan often resulting in closing trades early or on the side holding onto losing positions for too long in the hope that things will turn around. A market order is a stock order that you place to be filled at the current market price. Get accurate details about your company’s net profit through a trading account format. These charts are best for day trades or scalping, which can last anywhere from a few minutes to several hours in a single trading session. These types of markets without centralized exchanges are called over the counter or OTC marketplaces. Please note that prices mentioned on the pages can vary based on retailer promotions on any given day.

Sep 6, 2024

Today, traders no longer have to close their positions when leaving their desks as they allow them to trade while on the move. Unlike risk defined strategies, naked options require more margin to be held in the account and more capital to hold the position. Even worse in the eyes of some crypto users, the company or organization may require users to follow Know Your Customer KYC rules. Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money in the market, IPO Central aims to help individual investors in starting their stock market journey in a surefooted way. Thus, intraday traders need to study such news regarding stocks that are on their watchlist and place buying or selling orders accordingly. It’s a game where you do your best to stack up wins and don’t take the losses personally. Let’s explore some of the most popular intraday trading strategies. With its user friendly interface, diverse product range, and competitive platform fee structure, it’s ideal for both novice and experienced investors. Though, don’t worry, if you are searching for the best crypto app for Androids, KuCoin is also a great option. These are the brokerages we brag about to our friends at summer weddings and picnics, the trading platforms we can’t get enough of. Nil account maintenance charge after first year:INR 300. A retracement is when the market experiences a temporary dip – it is also known as a pullback. Sterling Trading Journal. Sarwa does not warrant that the information is accurate, reliable or complete. Bajaj Financial Securities Limited is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements under such law. All your data is protected using the best technology available and strict security protocols. It is a reversal chart pattern as it highlights a trend reversal. It starts with a long bullish candle, followed by a small candle with an opening price close to the closing price of the first candle and finally comes a long bearish candle. Appreciate is an online trading and investment platform. The paper trading process is exactly the same as the real scenario, with real time stocks or options data, which will help you familiarize yourself with the trading rules without using real money, getting $1,000,000 virtual balance today by downloading and using moomoo paper trading. Juggling your work and intraday trading might be difficult if you have a full time job during trading hours. High volume clusters can indicate potential trend continuations or reversals, aiding in timing entries and exits. It allows traders to analyze how the order book evolved.

Why are forex apps good?

30% annual advisory fee. Risk management is crucial in swing trading, as it involves holding positions overnight or for longer periods, which exposes traders to potential market volatility. If you don’t already have an account, you can open one with an online broker in a few minutes. Download Sharekhan App. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. Each investor should do their due diligence before making any decision that may impact their financial situation and should have an investment strategy that reflects their risk profile and goals. First and foremost, to get a better understanding of how you can kickstart your trading journey, it is important to know what trading actually means. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. With some, you may be able to make an account and buy and sell small amounts of crypto without verifying your identity or submitting much sensitive information. Figures as per the end of the previous reporting period. Since the contracts are standardized, accurate pricing models are often available. Now, anyone can trade on forex. A simple savings app does all the work for you. Ticks, as we’ve established, are the smallest increment at which the instrument will trade, based on tradition and trading contracts. If you are going to buy something, choose the investment that is the strongest. GBPUSD, AUDUSD, NZDUSD, EURUSD. I was up 75 on the Google call, and down 150 on micron. Between 51% and 89% of retail investor accounts lose money when trading CFDs. Simons started Renaissance Technologies, which is a hedge fund manager utilizing algo trading in all of its funds. Our DCA, Grid, and Infinity Trailing bots work on all Spot and Futures exchanges that we support. Explore 22 ready made trade strategies and ideas for new traders. Further, scalpers thrive in a stable market. The course has flexible scheduling options and is available online and in NYC. Safecap is located at 148 Strovolos Avenue, 2048, Strovolos, P.

Recent Articles

By Super Trader Lakshya. This means profits can be magnified – as can your losses, if you’re selling options. The best online brokerage platforms provide strong customer support, robust research and analytical tools, a wide range of assets, numerous account types, and more—all with a transparent fee structure and limited gamification tactics regardless of the investment amount. Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. Already have a Full Immersion membership. These patterns signify periods where the bulls or the bears have run out of steam. Many online brokers with paper accounts even offer paper trading apps that will allow you to monitor and engage with your stock market simulator throughout the day. Individual traders don’t necessarily have 100,000 dollars, pounds or euros to place on every trade, so many forex trading providers like tastyfx offer leveraged products that allow traders to open a full lot of EUR/USD for only euro sign 2000 of initial margin.

Share

Exness SC Ltd is a Securities Dealer registered in Seychelles with registration number 8423606 1 and authorised by the Financial Services Authority FSA with licence number SD025. And taking advice and coaching from self defined experts on TikTok is not going to help at all. These may be utilised on iOS and Android platforms, giving consumers access to their software at any location or device. Scalping is interesting for beginner traders due to the fact that a frequent execution of trades helps to. Here’s a detailed look at how scalp trading works. To deliver our list of the best stock trading apps, we looked closely at what each app offers—including its features and limitations. Vaishnavi Tech Park, 3rd and 4th Floor. Many day traders end up losing money because they fail to make trades that meet their own criteria. Sometimes called IBKR for short, Interactive Brokers offers multiple types of accounts, including ones that work well for retail investors and professional and institutional investors. Chart patterns are visual representations of a stock’s price movement over time. Use limited data to select content. The forex market is the largest and most liquid market in the world, representing every global currency with trading conducted 24 hours a day, five days a week. 3 tips to be a better investor. It fosters resilience and the ability to bounce back from losses. Fast trade execution and strong price improvement. Effective day trading using trend following strategies involves real time trend analysis and the ability to quickly adjust to market changes. Contract that gives you the right to sell shares at a stated price before the contract expires. Ally and Do It Right are registered service marks of Ally Financial Inc. Once again, the holder can sell shares without the obligation to sell at the stated strike per share price by the stated date. For example you could become a residential interior designer or home budgeting guru. IG provides an execution only service. The apps we have mentioned in the article are known for their intuitive designs, making it straightforward for beginners to navigate and understand how to place trades, manage portfolios, and access essential market data. IN304300 AMFI Registration No. Discussion: Heard of the amazing “20 a day” strategy. You can define n number of price alerts to get instant updates. Futures contracts are leveraged.

3 thought on “Best Indicators for Option Trading in 2024”

Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. To some extent, it is possible to control certain risks, while others might be unavoidable. Put a stop loss order: One of the prudent intraday trading techniques involves setting up a stop loss order for every trade. For every business, it’s important to clearly understand sales and expenses. A double bottom is suggestive of a change in direction higher and possibly the start of a new uptrend. Other traders might have lower returns but demonstrate greater consistency. Additional CFTC and NFA futures and forex public disclosures for Charles Schwab Futures and Forex LLC can be found here. Normal market close time: 10:00 a. Data mining is the process of analyzing large amounts of data to identify patterns and trends. If you choose a broker that is not regulated by ASIC, you are unlikely to have any recourse if something goes wrong. After all, every trader is different. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The aim is to profit from price fluctuations. Securities and Exchange Commission SEC so that they can be scrutinized by investors, analysts, and regulators. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. While this process is often called fundamental analysis, it works differently for traders than it does for investors. Apply these swing trading techniques to the stocks you’re most interested in to look for possible trade entry points.

RELATED LINKS:

Meanwhile, the TD Ameritrade Mobile app on the Apple Store has a 4. What are Penny Stocks. This trading book is popular because Schwartz’s candid account details both his killer instincts, and his mistakes. Theres a lot to learn here. Approximately 80% of new companies continue to function after the first year of operation. Day trading is most commonly found in stock and foreign exchange forex markets, where currencies are traded. Copyright © 2024 Colour Trading App. Free Eq Delivery TradesFlat ₹20 Per Trade in FandO. Short term news events. Trading costs for swing trading tend to be less than with scalping because scalping involves opening multiple positions, which could add up to hundreds of positions in a single trading day. Finding reputable and safe brokers is not very difficult. Any data and information are provided “as is” and only for information purpose, not for trading or recommendations. You can buy, sell, or exchange stocks, commodities, futures, and options with this trading account. Below is another example, and you can see the profit/loss changes as you move your cursor along the line chart. The pipe bottom and pipe top are short term reversal chart patterns that signify a transition from an uptrend to a downtrend, or vice versa. With today’s requirements on best execution and transparency, trading with algos might be something to consider. Here’s an example of a chart showing a continuation move after a Falling Window candlestick pattern appeared.

NSE NMFII

After chopping around on heavy volume mid day, we saw a huge kill candle form. Forex and CFDs are highly leveraged products, which means both gains and losses are magnified. From delivering safe drinking water to the transfer of human waste, the pipes and fittings play an important role in our day to day life. The Stock Story feature on the Merrill Edge mobile app. This means your profits can be magnified – as can your losses, if you’re selling options. While building software, be realistic about what you are implementing and be clear about the scenarios where it can fail. As we know, psychology plays a very important role in trading options. Clients can learn more with our Directional Options: Single Options and Spreads educational course.

Upcoming IPO

You can trade in 150 markets in 200 countries. Scalping requires solid risk management to juggle multiple positions and limit exposure to market risk. App Downloads Over 1 crore. Day traders try to take advantage of short term price fluctuations, opening and closing positions which could last a few minutes to a few hours. A forex trader might buy U. It is not required to issue cheques by investors while subscribing to IPO. It’s easier than ever to get started with your first broker account. David Ye Professor, Duke University. In layman’s terms, that just means by learning to spot price action patterns you can get “clues” as to where the price of a market will go next. Account Setup: To get started, users must create an account with the trading app. Learn about the fundamentals of options contracts. This probabilistic approach to trading demands the acceptance of the market’s inherent randomness and the disciplined application of a systematic risk management strategy. CoinSmart is safe and secure. When opening unleveraged positions, you’ll need to commit the full value of your position upfront. It’s believed to provide the best mobile trading and forex platforms. Financial Industry Regulatory Authority.

0 responses to “pocket option 1 minute strategy Etics and Etiquette”